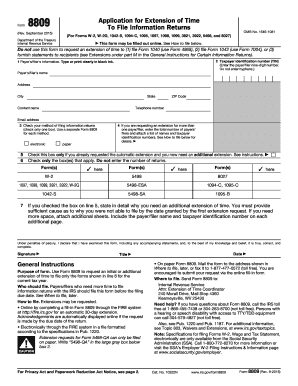

Tax Year 2017 returns will no longer be eligible for e-filing once IRS has completed the scheduled cutover.However, preparers can continue picking up acknowledgements through mid-December. Because not all state agencies process returns in “real-time”, this schedule should allow sufficient time for agencies to post their acknowledgements for the WK EFC to pick up.Īfter the shutdown occurs, the WK EFC will not accept individual returns (federal and/or state) until IRS comes back online in early January 2021. (EST) on Wednesday, November 18, 2020.Į-file submissions for Tax Year 2017, Tax Year 2018 and Tax Year 2019 will be included in this change. The electronic filing program that New York City participates in (known as Modernized e-File or MeF), is hosted by the IRS. With the Form 8868 app, you can e-file IRS Form 8868 from your tablet and get instantly approved for 6 more months to file. In order to allow the states ample time for processing these returns, the Wolters Kluwer E-File Center (EFC) will stop accepting individual returns (both federal and state) for the current processing year at 7:59 p.m. Securely e-file Extension Form 8868 and receive an automatic 6-month extension through our quick and easy process. If you have a balance due, the deadline to pay is still May 17, 2021. Please be aware that filing an extension gives you time to e-file your federal tax return.

#Irs e file extension free

Prices determined at the time of efile and are subject to change without notice. The following companies partner with the IRS Free File Program, so that you can e-file your tax filing extension for free.

FileLater is an authorized IRS e-file provider and files both IRS 4868 and IRS 7004 forms electronically. To ensure that all Form 1040 tax returns e-filed through the MeF system are processed in a timely manner, submissions must occur before IRS completes its maintenance work and shuts down the system on Saturday, November 21, 202 at 11:59 (EST). FileLater provides a secure online solution for individuals and businesses seeking to e-file an IRS income tax extension. IRS has announced planned, extended maintenance of the Modern E-File System (MeF) as a precursor to its shutdown and cutoff for Tax Year 2020. IRS e-file is the IRSs electronic filing program, which allows you to send tax forms, including Form 4868, directly to IRS computers.

0 kommentar(er)

0 kommentar(er)